Author(s):

Jeremy Fraiberg, Douglas Marshall

Dec 9, 2015

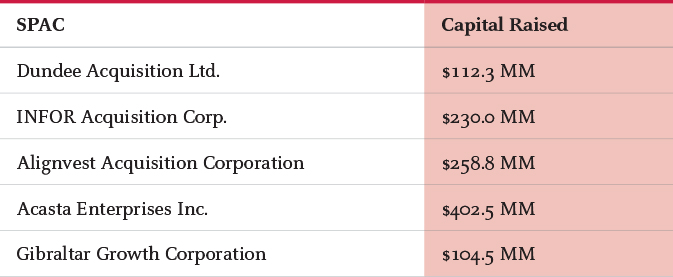

The wave of special purpose acquisition corporation (SPAC) offerings was arguably the biggest development in Canada’s capital markets in 2015. Although the TSX adopted SPAC rules in 2008, the first Canadian SPAC offering was only completed in April 2015. Four other deals followed in quick succession, raising over $1.1 billion in capital.

How SPAC Offerings are Structured

A SPAC is a publicly traded shell corporation that is formed to complete a “qualifying acquisition” of an operating business within 24 months (with the potential of an extension to 36 months if approved by investors). If a deal is not completed, investors get their money back with interest.

In all SPAC deals to date, the public has acquired Class A units, consisting of a Class A restricted voting share and 1/2 of a Class B share purchase warrant (one full warrant in the Gibraltar deal), at a price of $10 per share. Each warrant is exercisable for one Class B voting share at a price of $11.50 per share, and the warrants expire five years after completion of a qualifying acquisition. Each Class A restricted voting share automatically converts into a Class B voting share upon completion of a qualifying acquisition. The gross proceeds of the issuance of Class A units are held in escrow pending completion of a qualifying acquisition and are invested in short-term Canadian government securities with a maturity of 180 days or less.

The founders of the SPAC – a sponsoring entity and certain directors and officers – provide seed financing to the SPAC by purchasing Class B units, consisting of a Class B voting share and 1/2 of a Class B share purchase warrant (one full warrant in the Gibraltar deal), also at a price of $10 per unit. The seed financing covers underwriting fees and legal and other fees in connection with the IPO and qualifying acquisition.

Before the IPO, the founders also acquire initial shareholdings that constitute 20% of the Class B shares nominal consideration. These “founders’ shares” compensate the founders for the risk they have assumed with their seed capital, for their efforts in organizing the SPAC and for their ability to source and execute a successful qualifying acquisition. As a result, the average cost of the Class B shares for the founders has been in the range of $1.22 to $1.33 per share, as compared to $10 per Class A share for the public. The founders’ shares cannot be traded until the earlier of one year following the closing of a qualifying acquisition and the date on which the closing price of the Class B shares equals or exceeds $12 per share for 20 trading days within a 30-day trading period. In addition, 25% of the founders’ shares are subject to forfeiture unless the closing price of the Class B shares exceeds $13 for 20 trading days within a 30-day trading period in the five years following the qualifying acquisition.

A qualifying acquisition (or combination of related acquisitions) must have a fair market value of not less than 80% of the assets held in escrow and must be approved at a shareholders’ meeting by a majority of votes cast by Class A and Class B shareholders voting together as a single class. If the qualifying acquisition is approved by shareholders, the SPAC uses the escrowed funds to complete the acquisition (most likely with additional debt financing and the issuance of equity to the owners of the target business).

If the qualifying acquisition is not approved by shareholders and no qualifying acquisition is completed within the permitted timeline, escrowed funds are returned to the shareholders.

Class A shareholders have the right to exercise redemption rights in connection with the shareholders’ meeting to vote on a qualifying acquisition – regardless of whether they vote for or against or do not vote at all on the qualifying acquisition. However, in the deals to date, no single shareholder (together with any joint actors) can redeem more that 15% of the outstanding Class A shares. In addition, Class A shareholders have the right to keep their purchase warrants after they have redeemed their Class A shares.

Will SPACs Continue to be a Viable Asset Class?

A SPAC presents a potentially favourable investment opportunity to shareholders. They are effectively assured of a T-Bill return over a 24-month period, with the potential of further upside on their equity participation if a qualifying acquisition is completed.

In 2015, SPACs represented a new and attractive investment option. Whether SPACs will continue to be a viable asset class will likely depend on the current group of SPACs in completing successful qualifying acquisitions.

SPACs are potentially attractive for certain kinds of businesses that are considering either an IPO or a sale. A SPAC transaction may be the most desirable option where the owners of the business would like to remain in control but monetize a sizable stake, want a pre-established shareholder base, can benefit from the SPAC’s existing management team and experience, or where the IPO or M&A market may otherwise be closed.

However, SPACs also have certain limitations. With respect to a sale transaction, a SPAC must obtain shareholder approval before completing a deal. Other bidders aren’t typically subject to the same completion risk. Even if shareholder approval is obtained, shareholders may redeem too many shares, which could deplete the available cash and result in the SPAC being unable to complete the qualifying acquisition. Furthermore, without additional financing, SPACs are unable to provide deposits or pay break fees if deals are not completed, since their cash is escrowed

Going public through a SPAC is also not suitable for everyone. While marketing risk is avoided, it is replaced by the risk of having to obtain shareholder approval, as in a sale transaction. In addition, many issuers that go public prefer to do so directly rather than through a pre-existing publicly traded vehicle.

The United States has a fairly robust SPAC market, with some notable successes. Data from the United States from 2003 through September 2015 show that 228 SPACs completed IPOs, raising US$29 billion. Of these, 56% completed an acquisition, 1% announced an acquisition that has not yet been completed, 33% liquidated and 10% are still looking for an acquisition. See the “SPAC 2.0 – A Lightning Start, What’s Next?”, industry report by 4Front Capital Partners Inc., dated September 28, 2015.

Until one or more of the current group of Canadian SPACs completes a qualifying acquisition, it may be that the market window for new SPAC offerings is closed (although two SPACs – Avingstone Acquisition Corporation and Kew Media Froup Inc. – have filed preliminary prospectuses). SPACs have become a permanent feature of the U.S. capital markets and there is no reason to think that a similar market in Canada won’t also emerge. Time will tell how big a long-term market exists and whether 2015’s initial wave of transactions will spawn more in the future.

Note: Osler acted for the underwriters on the Alignvest Acquisition Corporation SPAC offering.