Author(s):

Chad Bayne, Jillian Mulroy, Michael Budabin McQuown, Marc Kushner

Sep 26, 2018

The recent reshaping of indemnification norms in U.S. private M&A deals caused by the exponential growth and widespread acceptance of representations and warranties (R&W) insurance is the most significant shift in the North American market since the death of the financing in the mid-2000s.

The new normal

In the new normal, a seller in the U.S. market can utilize R&W insurance to limit exposure for breach of most R&W in a purchase agreement to no more, and usually less, than 1 percent of the purchase price, with the buyer agreeing that its sole recourse for losses in excess of this cap will be to the insurance policy.

By using this approach to shift indemnity risk to the insurance provider, the seller can achieve a reduction in indemnification exposure, and an increase in certainty of deal proceeds, that was previously nearly impossible to obtain outside the public company (and some private equity selling) contexts.

And with dealmakers having become comfortable that R&W insurance claims will be paid, U.S. buyers have embraced the trend, seeing both no way to fight the force of the market, and concluding that they too can benefit.

That’s because for the price of an incremental premium increase, which can often be shared with the seller, a buyer can generally obtain more comprehensive indemnification coverage than what may be generally negotiated between the parties, absent R&W insurance, with less friction and delay between the parties in the deal process.

This is especially so given that U.S. deal terms are typically more pro-seller than Canadian terms, with shorter survival periods for R&W and smaller caps on indemnification obligations when taken as a percentage of the purchase price.

Despite the general trend of convergence of terms in the Canadian and U.S. M&A markets, we wrote recently that the indemnification packages in Canadian deals generally remain more favourable to buyers than in the United States, and noted that sellers in Canada could leverage the market differences to their advantage and narrow the gap by proposing U.S.-style deal terms, which are considerably more seller-friendly.

R&W insurance makes it easier for a seller to achieve this goal in the Canadian market, and it can provide Canadian buyers with a mutually beneficial alternative to simply opposing the force of an unfavourable, but likely unstoppable, market trend that is reducing their home-field advantage.

Taking the plunge

For a growing number of dealmakers in the United States and Canada, the question regarding R&W insurance is when, not whether, to take the plunge.

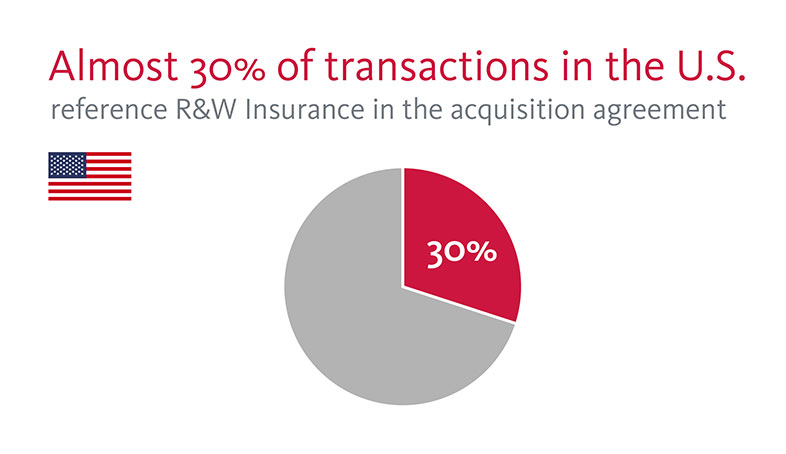

In the 2017 ABA U.S. Deal Points Study, almost 30 percent of transactions reference R&W insurance in the acquisition agreement.

Marsh, one of the biggest brokers in the R&W insurance marketplace, reported binding 406 transactional risk insurance policies (which include R&W insurance policies) in 2017, up from 280 in 2016 and a 46 percent increase over 2016 in the total transactional risk limits placed in the United States and Canada.

This is notably higher than the increase of 28 percent more transactional risk insurance policies bound globally over 2016 levels, and a 38 percent increase in total transactional risk limits placed globally.

These numbers can be expected to continue to climb.

Helping yield “win-win” outcomes

To understand the growing value and market acceptance of R&W insurance, it is helpful to understand the cross-border M&A trends regarding indemnification, and to focus on how R&W insurance can be deployed to the advantage of both buyers and sellers to yield “win-win” outcomes and smooth the potential disruption of ongoing market convergence.

Take a typical example: a Canadian seller, perhaps following our tips to propose a “U.S. deal” indemnification package (i.e., a shorter survival period for R&W, a lower cap on indemnification obligations and a deductible rather than a tipping basket).

That seller may find that there is a still large, though narrowing, gap between its desired terms and those that the Canadian buyer across the table, who is following current Canadian market norms and expecting more buyer-friendly protections, might be prepared to accept.

Especially where one party does not have the leverage to force the other into the “U.S.-style” or “Canadian-style” deal it seeks, a potentially time-consuming, frustrating, and costly impasse may result.

R&W insurance is a product that can bridge the gap and defuse an impasse before it starts by allowing each side to obtain more of the commercial result it seeks, an outcome that would be similar to what a negotiation sans insurance would likely yield, without engaging in a protracted negotiation.

Use of R&W insurance in this scenario would ensure that the buyer would receive much more, if not all, of the indemnification comfort it seeks from a creditworthy counterparty and, in our view, one with more of a market incentive to behave reasonably in response to an indemnity claim than a typical seller.

And in a classic “win-win,” a U.S.-market standard R&W insurance deal indemnity would allow the seller to sharply limit its post-closing exposure to claims to an extent not otherwise available in the Canadian market.

Along with these efficiencies, the parties should expect that everything else equal, the R&W in an acquisition agreement are likely to end up more buyer-friendly, and the indemnification package more seller-friendly, than a deal without R&W insurance.

While there is currently no ABA Canadian Deal Points Study to verify our anecdotal experience, we see the Canadian market continuing to converge with the U.S. market, and predict that the seemingly inevitable increase in use of R&W insurance will accelerate the trend.

Let’s look at the details, and how R&W Insurance can change the deal equation.

(1) Caps

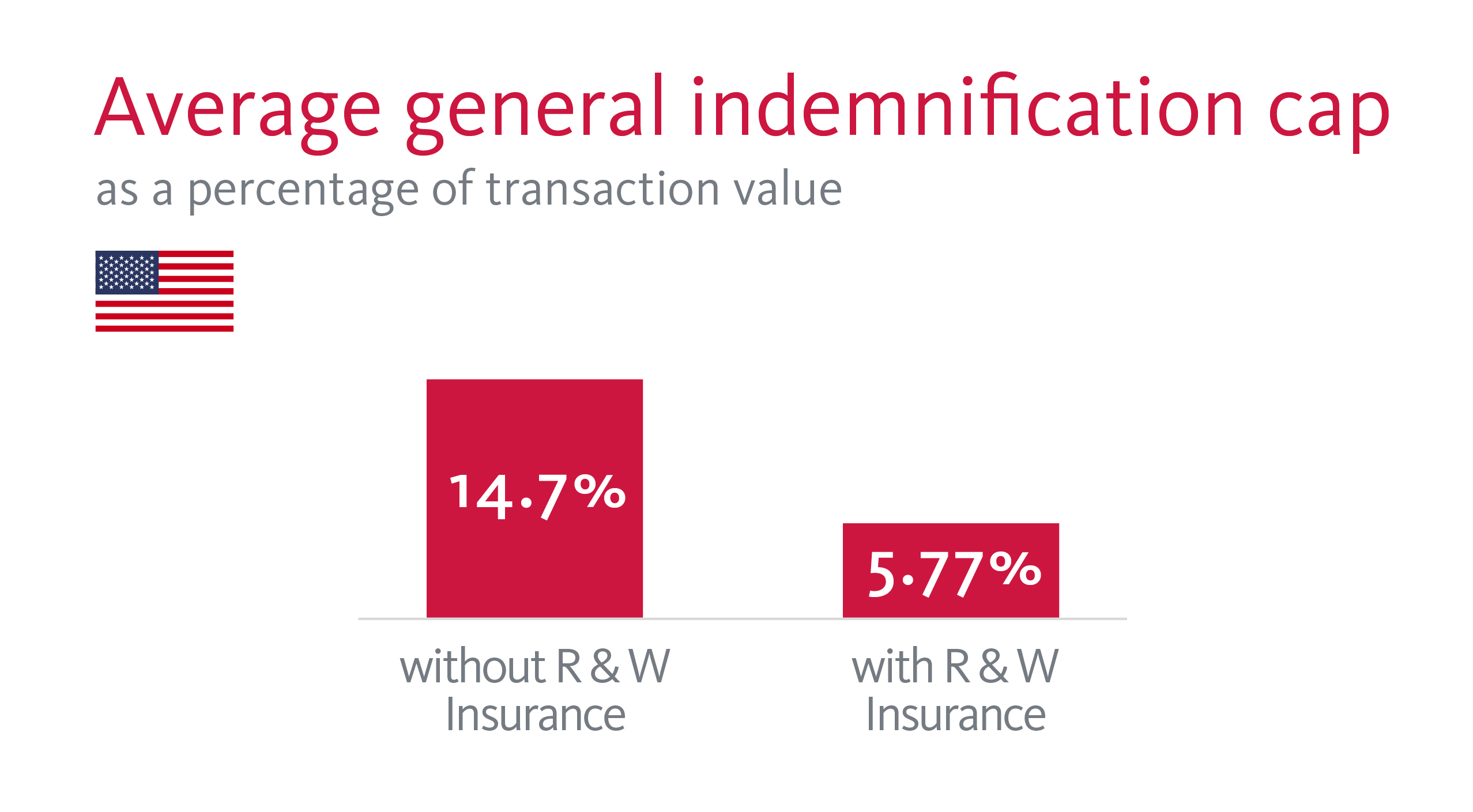

The 2017 ABA Deal Points Study in the United States found that the average general indemnification cap, as a percentage of transaction value, was 14.70 percent without R&W insurance and 5.77 percent with R&W insurance.

The most recent ABA Canadian Deal Points Study (from 2015) highlighted that the Canadian market typically has much higher general indemnification caps, with 23 percent of deals having capped indemnification obligations at the purchase price and only 26 percent of deals with a cap of 15 percent of the purchase price or less.

The recent U.S. experience shows the transformative impact of R&W Insurance, and we expect the product to have a similar impact in Canada by accelerating the trend toward decreasing the size of caps of indemnification obligations, which would be an attractive trend for Canadian sellers.

But concerned buyers in Canada can offset this trend by purchasing an R&W insurance policy that provides incremental coverage in excess of the standard converging market indemnity cap.

Such additional insurance is generally available at rates that decline as the cap on coverage increases.

(2) Survival periods

As we mentioned in our prior article, survival periods for most R&W are generally longer in Canada than in the United States. Deals in Canada are more likely to offer 12 to 24 months of protection, as opposed to 12 to 18 months in the United States.

Interestingly, standard R&W insurance will generally reverse the trend toward shorter survival periods in both the U.S. and Canadian markets because the policy typically extends the survival period under the policy to three years for general R&W and offers six years of coverage for fundamental R&W, in each case without requiring parallel survival periods under the purchase agreement under which the seller is obligated.

This provides another “win-win” result where the scope of the buyer’s coverage goes up without a corresponding increase in the seller’s exposure.

(3) Scrapes

Especially in Canada, where it is less prevalent, sellers still tend to resist the “materiality scrape,” which is a pro-buyer provision that disregards any materiality qualifiers in the sellers’ R&W when determining whether a breach has occurred and/or when calculating any related damages.

Sellers in the United States have by and large accepted this approach, with approximately 85 percent of U.S. deals containing this provision.

The Canadian market is moving in this direction, though the trend is not nearly as pervasive. Past Canadian ABA Deal Points studies have shown increasing adoption of the materiality scrape in Canada, with 11 percent of deals in the 2012 and 2014 studies including such a provision and up to 39 percent of deals in the most recent 2015 study, and we expect this convergence to continue.

As a result of R&W insurance, some parties find that negotiations over this important, but perhaps arcane, provision are less protracted.

Sellers may accept the scrape and focus instead on ensuring that overall indemnity exposure is limited.

This should be the case in a standard R&W insurance deal, where the incremental risk of a loss will be limited to a smaller slice of the purchase price, 0.5 percent in a typical deal where buyer and seller split a 1 percent policy retention (or deductible), after which the buyer will be contractually required to look exclusively to the R&W Insurance in the event of a loss.

We think this is a trade most sellers would willingly embrace, although it is important to note that R&W insurers will insist that all disclosures are prepared without regard to the materiality qualifiers contained in the representations.

(4) Types of damages

Recent Canadian and U.S. ABA Deal Points studies show that deals often have express exclusions to the types of damages covered by the indemnification provisions.

For example, 25 percent of deals in the United States and 22 percent of deals in Canada will exclude incidental damages, 76 percent of deals in the United States and 57 percent of deals in Canada will exclude punitive damages, 39 percent of deals in the United States and 42 percent of deals in Canada will exclude consequential damages, and 23 percent of deals in the United States and 14 percent of deals in Canada will exclude losses based on diminution in value.

While not universal, the presence of R&W insurance in a deal tends to reduce the negotiation surrounding the types of damages or losses that will be indemnified.

One of the benefits of R&W insurance is, so long as the acquisition agreement is silent on the issue, coverage will typically not exclude indirect, consequential and incidental damages, or losses based on diminution in value and a multiple of earnings.

This minimizes yet another potential point of contention between buyer and seller and often resulting in a better outcome for a buyer on either side of the border than would otherwise be obtained.

More comprehensive, less expensive insurance

There has never been a better time for dealmakers to utilize R&W insurance to supplement or replace traditional contractual protections such as seller indemnities and escrows, as growing market acceptance of transactional insurance has increased competition among insurers.

This has in turn resulted in an expansion of the scope of coverage and a reduction in the cost of a typical policy.

(1) Premiums have dropped

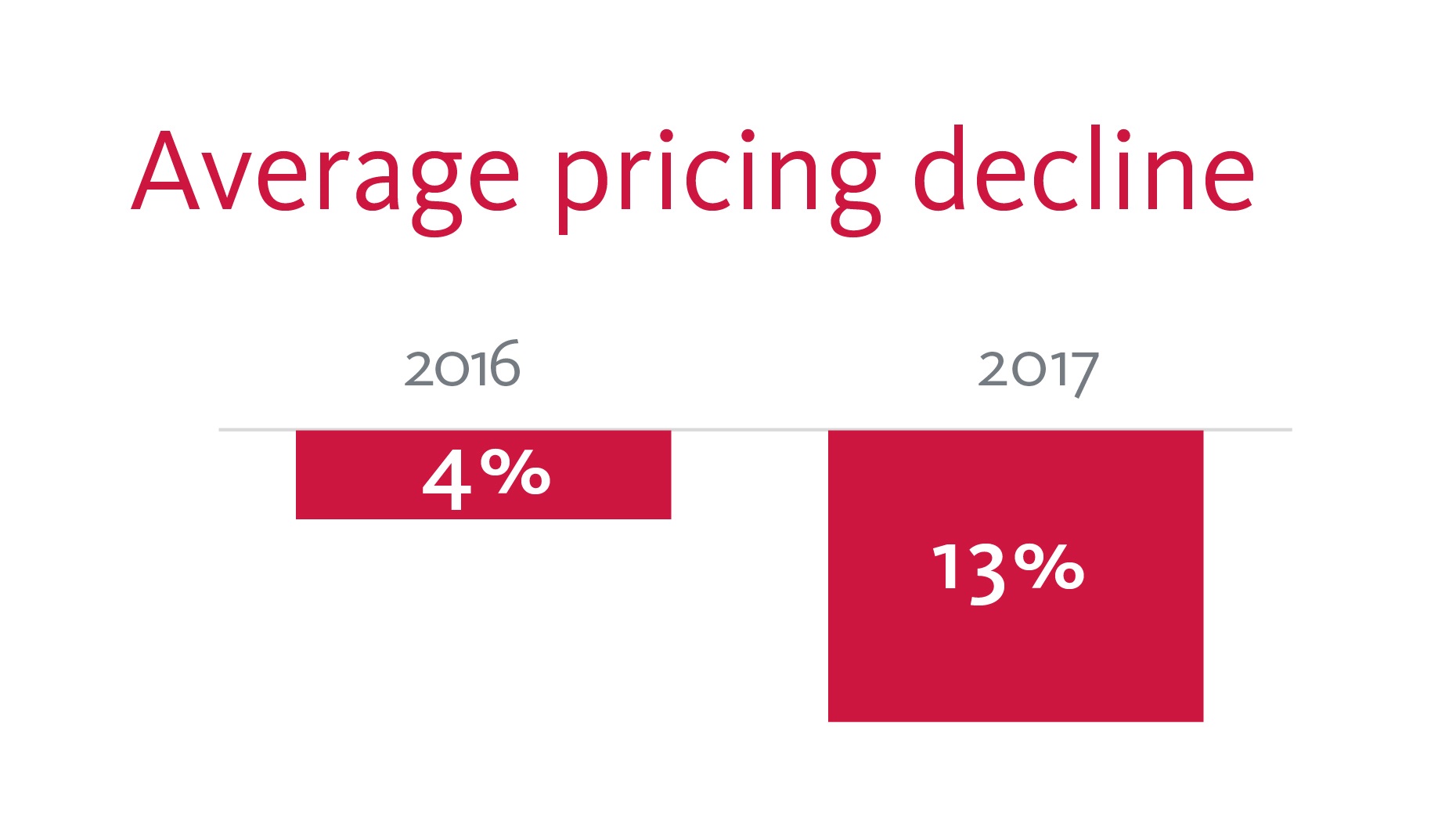

As noted, increased competition in the R&W insurance market, driven by growth in dealmaker demand and an increase in the number and sophistication of the insurers, has led to more favourable pricing. In 2017, Marsh cited a pricing reduction of an average of 13 percent compared to a 4 percent reduction in 2016.

Where three years ago R&W insurance premiums tended to average 3 percent to 4 percent of coverage limits (assuming a standard retention (i.e., deductible) of 1.5 percent to 2 percent ), premiums today are often seen in the range of 2.5 percent to 3.5 percent of coverage limits (with a now relatively standard 1 percent retention available for most transactions).

This means that for a $100-million transaction, the cost of $10 million in coverage, including three years of coverage for general R&W and six years for fundamental R&W, may be secured by a one-time up-front payment of approximately $300,000.

(2) Coverage is broad and expanding

Moreover, while R&W insurance continues to exclude known problems (which sellers must generally address via special indemnities or purchase price reduction), and typically certain “hot-button” items such as pension plan underfunding and asbestos liability, the combination of increased competition and underwriting sophistication has led to fewer standard exclusions (which are typically risks assumed by the buyer), and more narrow deal-specific exclusions, than when the product was first introduced to the market.

For example, buyers no longer encounter the historic and previously ironclad insistence on excluding coverage for environmental matters, with a growing number of insurers willing to insure environmental R&W if the target is not in a high-risk industry and the level and scope of buyer diligence on the issue is solid.

Similarly, insurers are increasingly willing to insure transactions where the target does not have audited financial statements, though this is often negotiated on a case-by-case basis.

Finally, and perhaps most importantly, the R&W insurance market now easily accommodates transactions where the seller has no “skin in the game,” i.e., no indemnity exposure at all, though often there is a slight increase in the premium to cover what is still viewed in the industry as the incremental risk.

We note, however, that notwithstanding this general trend toward expanding coverage, an R&W insurance deal does leave at least three gaps in a buyer’s customary package of indemnification protections, as compared to a non-R&W insurance deal.

First, the buyer must typically accept that it will have no contractual or insurance coverage for losses that arise from matters subject to the standard policy exclusions, other than the portion of such a loss (typically 0.5 percent of the purchase price) that might be covered by the seller before exhausting the policy retention.

Second, while the policy will typically extend the survival period for breach of the fundamental representations (e.g., capitalization and due authority) to six years, it will not generally provide incremental coverage beyond the agreed general indemnification cap (e.g., 10 percent to 15 percent of the purchase price in many U.S. deals).

This means the buyer must forgo the incremental coverage for breach of fundamental matters that a seller would typically provide in a non-R&W insurance deal, where the cap could equal the full purchase price, as the market terms often exclude fundamental matters from the general indemnification cap.

Third, coverage that the buyer may have under the R&W insurance policy for losses under a pre-closing tax indemnity will likely not exceed the general indemnification cap so, as was the case with losses for breach of the fundamental representations, the buyer must forgo incremental coverage for losses from pre-closing taxes that a seller would typically provide in a non-R&W Insurance deal, where a market cap would often equal the full purchase price.

And while many of these gaps appear in areas that arise infrequently, all buyers, and especially buyers with significant deal leverage, should assess whether the benefits of R&W insurance to their specific transaction are worth the expense of purchasing coverage and the incremental loss of customary indemnity coverage noted above, and whether it is possible to mitigate this loss.

One solution to the “reduced” coverage for breach of fundamental matters is to purchase incremental insurance coverage and/or supplement that insurance with contractual protection in the form of recourse to the seller for fundamental matters or pre-closing taxes.

Special indemnities or escrows could otherwise address potential gaps in coverage, but raising these issues in a negotiation may reinstate the type of potentially problematic deal negotiating issues that R&W insurance can generally alleviate.

Overall, while we expect to see continued, and increased, use of R&W insurance by strategic buyers due to the many benefits described above, certain buyers may find themselves with sufficient negotiating leverage that there is no need to bridge the negotiating gap with R&W insurance and that they can therefore avoid the added expense of obtaining a policy and the incremental exposure noted above.

For example, we have seen this deal dynamic in the technology space in Canada, where the leverage disparity is sufficiently large to enable some strategic buyers to “dictate” deal terms to the seller, leading to a buyers’ preference for traditional contractual arrangements over R&W insurance.

And claims are being paid

A consistent claims history has helped dealmakers accept R&W insurance as a viable substitute for seller indemnification.

We are of the view that unlike the average seller, who generally has little or no commercial interest in paying claims, or even being calm and reasonable in the face of a claim, R&W insurers expect to receive and pay claims in the ordinary course of business.

To us, this is a net benefit to the average buyer.

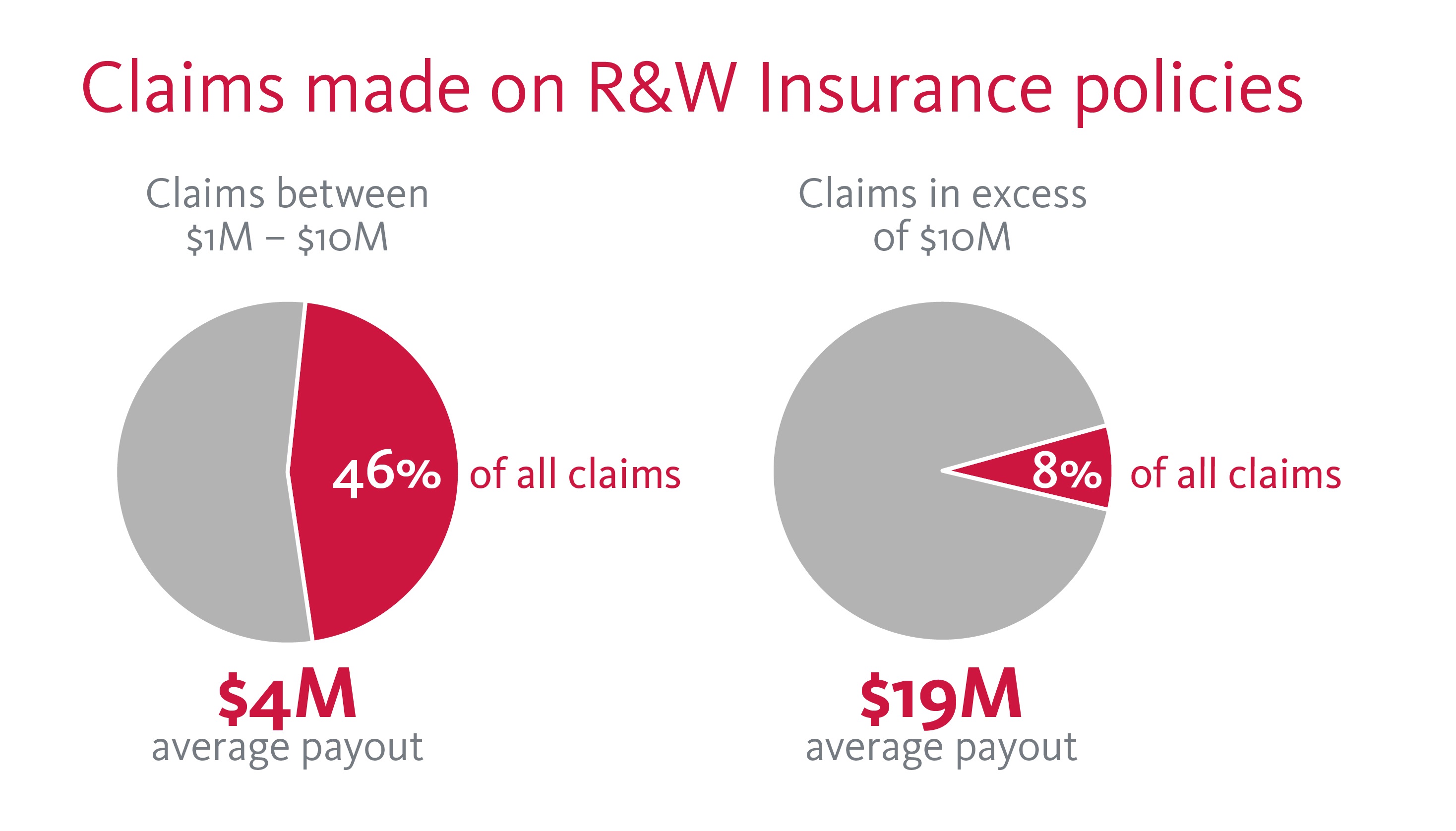

While insurer data is admittedly used for marketing, we note for example that in its 2018 report on claims made on its R&W insurance policies, AIG stated that almost one in every five policies receive a claim notification. Interestingly, it is the larger deals that have the highest claim frequency, with almost one in four policies receiving a claim notification when the transaction size is north of $1 billion, and not surprisingly these policies have the largest claim payouts.

AIG also reported an increase from 2017 levels in the incidence of claims for over $10 million, sitting currently at 8 percent of all claims. And the average size of the payouts for claims in excess of $10 million is $19 million, indicating that insurers are paying out on material claims. Similarly, $4 million is the average payout on smaller, but still significant, claims in the range of $1 million to $10 million, which represent 46 percent of all claims.

Concluding thoughts

In a trend that is transforming the U.S. M&A market, sellers are using R&W insurance to limit their exposure for breach of most R&W in a purchase agreement to no more, and often less, than 1 percent of the purchase price.

And buyers in the U.S. market are benefiting by purchasing a scope of coverage from creditworthy insurers that they could not otherwise obtain from a seller in the U.S. market.

And in this “win-win” trend, an initial agreement on standard R&W insurance terms is allowing buyers and sellers to get to “yes” more quickly, and at lower cost.

We expect to see more dealmakers leverage R&W insurance as a tool to help bridge the gap in deal negotiations, especially with respect to indemnification matters. All of this is coming to Canada and, in our view, the question for savvy Canadian dealmakers is how to best ride the wave.