A Guide to Canada's

Merger Notification Rules

The Competition Act

This tool guide is designed to assist you in determining whether a transaction is subject to the pre-closing mandatory notification regime of Canada’s Competition Act.

However, it is important to recognize that the Commissioner of Competition has the right to review and challenge any merger, regardless of whether it is subject to the notification regime, if the Commissioner believes that the merger is likely to substantially lessen or prevent competition in a relevant market.

Does the Transaction meet the Notification Thresholds?

To determine whether a transaction requires notification it must meet the following criteria:

Party Size

Threshold

Do the parties to the transaction and their affiliates have aggregate assets in Canada, or gross revenues from sales in, from or into Canada, in excess of C$400 million.

Notification

is not required

Need Help? Contact one of Osler’s Competition experts.

Meet our team:

-

Shuli Rodal

Partner and Chair, Competition/Antitrust & Foreign Investment

416.862.4858

srodal@osler.com -

Michelle Lally

Partner, Competition/Antitrust & Foreign Investment

416.862.5925

mlally@osler.com -

Kaeleigh Kuzma

Partner, Competition/Antitrust & Foreign Investment

403.260.7046

kkuzma@osler.com

Definitions

Challenge

Only the Commissioner can challenge a merger under the Competition Act; there is no ability for private parties to do so. Applications are heard by the Competition Tribunal, which is a quasi-judicial body comprised of a rotating panel of lay and judicial members with expertise in business, economics and the law.

Merger

“Merger” is broadly defined as the “acquisition or establishment, direct or indirect, by one or more persons, whether by purchase or lease of shares or assets, by amalgamation or by combination or otherwise, of control over or significant interest in the whole or a part of a business of a competitor, supplier, customer or other person.”

Substantially Lessen or Prevent Competition

A substantial lessening or prevention of competition results only from mergers that are likely to create, maintain or enhance the ability of the merged entity, unilaterally or in coordination with other firms, to exercise market power. Refer to the Bureau’s Merger Enforcement Guidelines.

Canadian Dollars

Conversions to Canadian dollars must use the Bank of Canada noon exchange rate on the last day of the relevant annual period.

Audited Financial Statements

Where audited financials for the most recently completed fiscal year are not available, calculations are based on amounts stated in the person’s books, in accordance with accounting principles that are generally accepted for the type of business carried on by that person. No specific accounting standard (i.e. GAAP, IFRS) is mandated.

Parties

For each transaction type, the parties are as follows:

- Asset acquisition - the person or persons who propose to acquire the assets, and the vendor of the assets.

- Share acquisition - the person or persons who propose to acquire the shares, and the corporation the shares of which are to be acquired.

- Amalgamation - the corporations to be amalgamated.

- Acquisition of an interest in an unincorporated combination - the person or persons who propose to acquire the interest, and the combination whose interest is to be acquired.

Affiliates

Affiliate means the following:

- One entity is affiliated with another entity if one of them is a subsidiary of the other or both are subsidiaries of the same entity or each of them is controlled by the same entity or individual.

- If two entities are affiliated with the same entity at the same time, they are deemed to be affiliates of each other.

- An individual is affiliated with an entity if the individual controls the entity.

An entity is a subsidiary of another entity if it is controlled by that other entity.

A corporation is controlled by an entity or an individual if the securities of the corporation to which are attached more than 50% of the votes that may be cast to elect directors of the corporation are held, directly or indirectly, whether through one or more subsidiaries or otherwise, other than by way of security only, by or for the benefit of that entity or individual, and the votes attached to those securities are sufficient, if exercised, to elect the majority of the directors of the corporation.

An entity other than a corporation is controlled by an entity or individual if the entity or individual, directly or indirectly, whether through one or more subsidiaries or otherwise, holds an interest in the entity that is not a corporation that entitles them to receive more than 50% of the profits of that entity or more than 50% of its assets on dissolution.

Assets in Canada

The asset assessment for both the Party Size and the Transaction Type thresholds is based on assets located in Canada.

Adjustments may be required:

Deduct:

- Any amount that represents duplication arising from transactions between affiliates.

- Any amount that represents duplication arising from an ownership interest (including minority interests) of one person in another person.

- Any amount provided for depreciation or diminution of value (as reflected in the financial statements for the most recently completed fiscal year).

Consider subsequent transactions or events, including:

- A write-down or re-evaluation for financial reporting purposes of the value of any assets.

- Any disposition, acquisition or reorganization that is likely to have a material effect on the aggregate value of assets.

- Any agreement, arrangement, understanding or other transaction or event that is likely to have a material effect on the aggregate value of assets.

In, From or Into

Gross revenues “in, from or into” Canada refers to domestic sales, export sales to a foreign jurisdiction, and import sales from a foreign jurisdiction.

Adjustments may be required:

- Deduct any amount that represents duplication arising from transactions between affiliates.

- Consider subsequent transactions or events, including any agreement, arrangement, understanding or other transaction or event that is likely to have a material effect on the aggregate gross revenues from sales.

- Do not deduct expenses or other amounts incurred.

In or From

Gross revenues “in or from” Canada refers to domestic sales and export sales to a foreign jurisdiction.

Adjustments may be required:

- Deduct any amount that represents duplication arising from transactions between affiliates.

- Consider subsequent transactions or events, including any agreement, arrangement, understanding or other transaction or event that is likely to have a material effect on the aggregate gross revenues from sales.

- Do not deduct expenses or other amounts incurred.

Prescribed and Narrowly Interpreted Three Part Test

The formation of non-corporate joint ventures are exempt so long as the following conditions are met:

- all of the parties who propose to form the joint venture are parties to an agreement in writing (or intended to be put in writing) that requires one or more of them to contribute assets and governs a continuing relationship between them;

- no change in control over any party to the joint venture would result from the formation of the joint venture; and

- the joint venture agreement restricts the range of activities that may be carried on by the joint venture and contains provisions that allow for its orderly termination.

Underwriting

Underwriting of a security refers to the primary or secondary distribution of the security, in respect of which a prospectus is required to be filed, accepted or approved under a Canadian or foreign securities law regime, or would be required to be filed, accepted or approved but for an express exemption under a Canadian or foreign securities law regime.

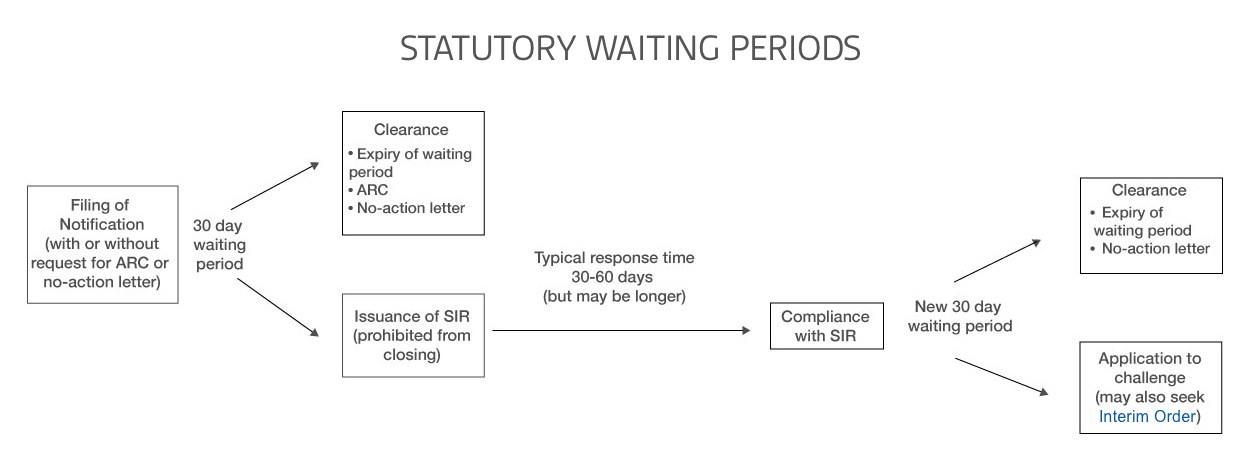

Advance Ruling Certificate

An ARC provides an exemption from the notification requirements of the Competition Act and effectively precludes the Commissioner from challenging the transaction so long as the transaction is completed within one year. Accordingly, ARCs are only issued where it is clear that the transaction will not substantially prevent or lessen competition in Canada. Where the Commissioner is not prepared to issue an ARC, the Commissioner may issue a “no-action” letter.

No-Action Letter

A “no-action” letter is a lesser form of legal comfort from the Commissioner than an ARC, as it states that the Commissioner does not currently intend to make an application challenging the transaction (but reserves the right to do so for up to one year after closing). In practice, the Commissioner has never challenged a transaction after issuing a “no-action” letter. Therefore, in practice (but not in strict legal terms) a “no-action” letter delivers essentially the same comfort as an ARC.

Special Timing Rules

Where a bidding party files a notification, the Commissioner is required to notify the target company immediately, and the target is then required to file its portion of the notification within ten days. The timing of the target’s response does not affect the running of either the initial waiting period or the waiting period following the bidding party’s response to a SIR.

Notification Form

This is a statutorily-prescribed form to be completed by each party to the transaction. The form requires specific information about the transaction (e.g., structure and consideration), the business of each of the parties and their respective affiliates, including detailed customer and supplier information, and “all studies, surveys, analyses and reports that were prepared or received by an officer or director of the party for the purpose of evaluating or analyzing the proposed transaction with respect to market shares, competition, competitors, markets, potential for sales growth or expansion into new products or geographic regions”.

Request for an ARC or a No-Action Letter

There is no prescribed form for a request for an ARC or a no-action letter. Such requests, which often are in letter format, set out a description of the transaction and parties, each party’s rationale for the transaction, and a detailed explanation, with supporting data and facts, as to why the proposed transaction is not likely to substantially lessen or prevent competition having regard to the factors in section 93 of the Competition Act and the Bureau’s Merger Enforcement Guidelines.

Supplementary information request

Whether to issue a SIR to the parties to a transaction, and the content of a SIR, is a unilateral Bureau decision. The Bureau will generally provide a draft SIR to the recipient party and, at that party's election, engage in a dialogue regarding the information requests set out therein.

Refer to the Bureau’s Merger Review Process Guidelines.

Interim Order

Where the Commissioner has filed an application to challenge a transaction, the Competition Act provides the Commissioner may also seek an interim order to, for example, require that certain assets be held separately upon closing, pending resolution of the Commissioner's challenge.