On August 28, 2017, Investment Management Corporation of Ontario (IMCO) (on behalf of its client, Ontario Pension Board), Honeywell pension and EagleTree Capital completed a definitive agreement in partnership with current management to acquire a majority stake in Corsair from Francisco Partners and several minority shareholders valued at US$525 million.

Investment Management Corporation of Ontario is an independent investment management firm designed to serve public-sector clients in Ontario. With approximately $60 billion in assets under management, IMCO is headquartered in Toronto.

EagleTree Capital, formerly Wasserstein Partners, is a leading independent private equity and investment firm, focused primarily on leveraged buyout investments and related investment activities. EagleTree Capital is located in New York.

Francisco Partners is a leading global private equity firm, which specializes in investments in technology businesses. Francisco Partners is located in San Francisco.

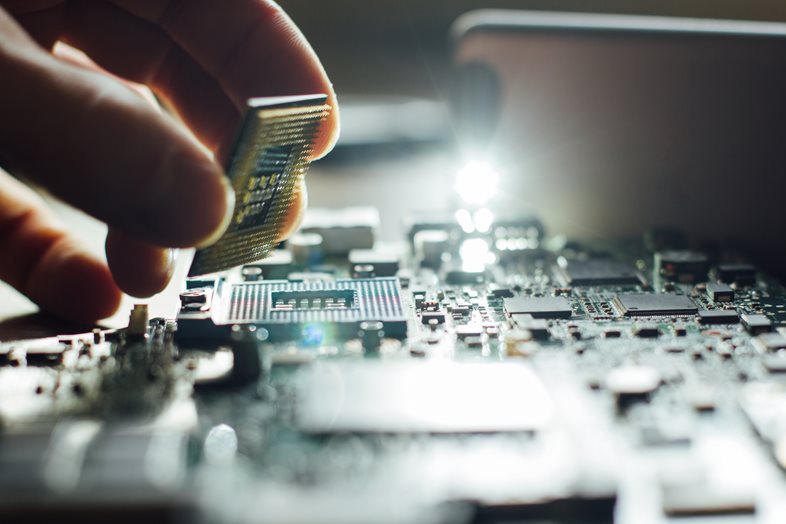

Corsair Components, Inc. is an American computer peripherals and hardware company headquartered in Fremont, California.

Osler, Hoskin & Harcourt LLP represented IMCO with a team led by John Groenewegen (Corporate) and Jack Silverson (Tax) that included Paul Litner, Douglas Rienzo (Pensions and Benefits), Jennifer Lee and David Davachi (Tax).