Author(s):

Paula Olexiuk, Dana Saric, Jesse Baker

Dec 8, 2020

Alberta is the fastest growing jurisdiction in Canada from the perspective of renewable power development. This is a result of, among other things, the strength of Alberta’s wind and solar resources, its unique deregulated wholesale electrical generation market, government incentives provided under the market-based Technology Innovation and Emissions Reduction (TIER) regime and the abundance of electricity offtakers.

Renewable developers, offtakers and other market participants should be aware of the following five key developments in 2020.

1. Growth in demand for Power Purchase Agreements (PPAs) from private offtakers

Market activity for private PPAs in Alberta has increased materially in recent years, mainly as an environmental, social and corporate governance (ESG) strategy used by numerous significant offtakers. The PPA market has continued to be active throughout 2020, despite reduced power consumption and a depressed forward power price curve resulting from the COVID-19 pandemic.

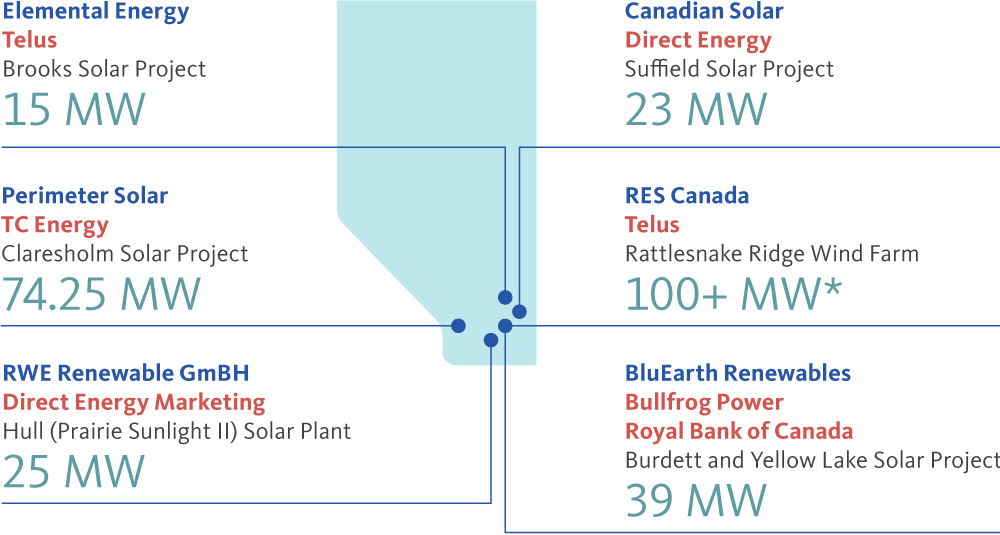

Figure 1 below shows a select number of publicly announced private PPA transactions in Alberta, with offtakers including TELUS, Direct Energy (2019 and 2020), TC Energy Corporation and Bullfrog Power / Royal Bank of Canada. Note that the existence and details of private, bilateral PPA transactions are often undisclosed.

FIGURE 1:

PUBLICLY AVAILABLE PRIVATE PPA ACTIVITY 2017-2020

*Press releases report a PPA for the “majority” of 117.6 MW capacity

Alberta’s deregulated electricity market has resulted in particularly volatile power prices. Without a PPA, a generator must sell electricity at the highly variable Alberta pool price and find a purchaser for environmental attributes, such as carbon emission offsets (which also vary in price). Not having a PPA makes it difficult to secure project financing to develop a project in a volatile market-price environment and in the absence of subsidies or other regulatory incentives. The strong and growing demand for the purchase of renewable power in Alberta by corporate offtakers via PPAs is expected to drive growth in renewable power generation and translate into significant growth for the sector.

2. Government procurements: Nice to have, but not necessary

Recent government procurement programs have accelerated renewable project development in Alberta. Government offtakers are particularly attractive for off-balance sheet-financed projects. Such projects allow developers to reliably source project level debt financing on the back of a long-term offtake contract with a creditworthy governmental counterparty.

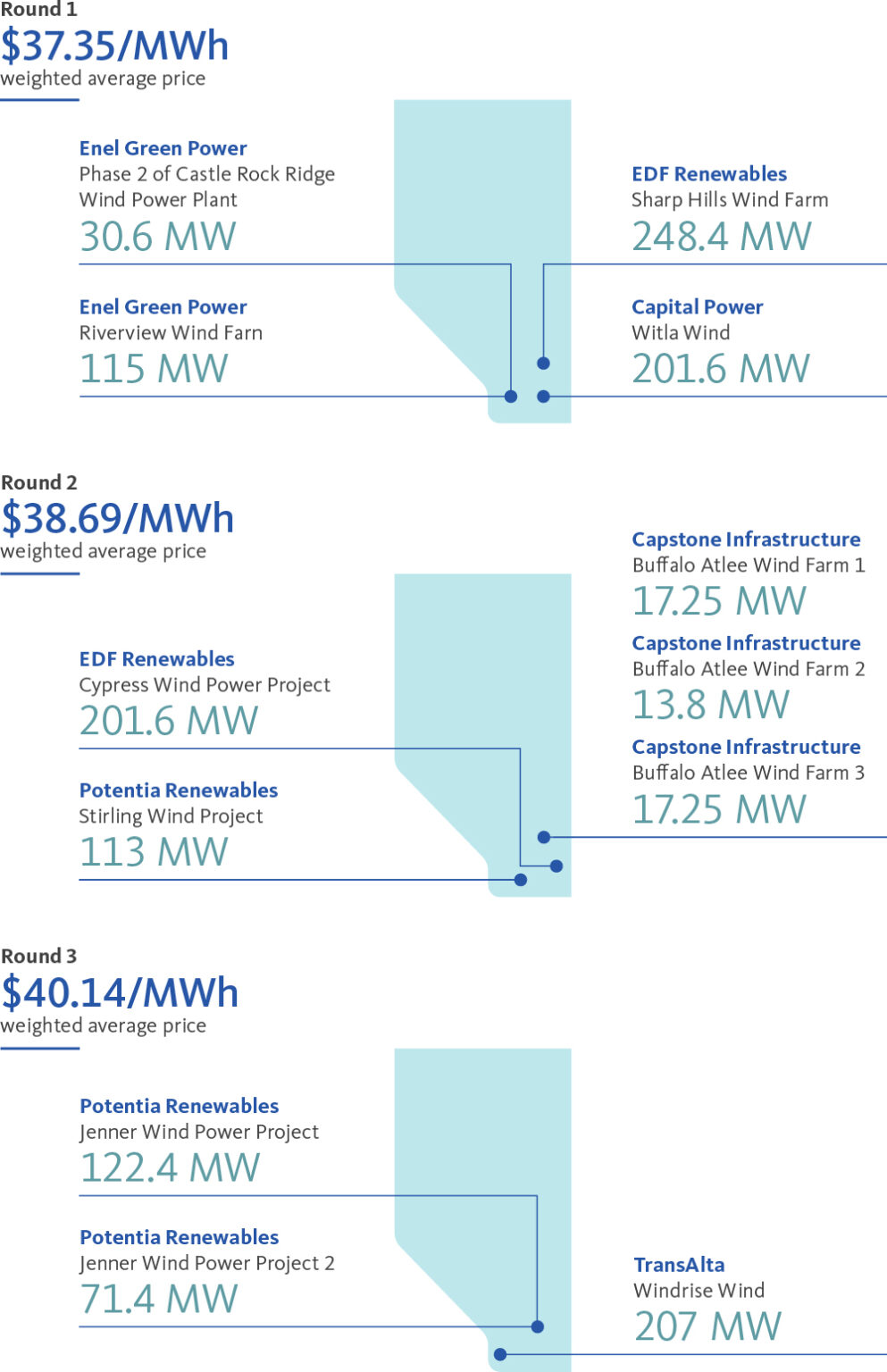

In 2017 and 2018, the Alberta Renewable Electricity Program (REP) awarded PPAs for 12 renewable wind projects (Figures 2, 3 and 4), representing a total of 1,359 MW of incremental nameplate generation capacity for the province. These projects were selected from a total of 59 projects for which bids were submitted (as reported by the Alberta Electric System Operator (AESO)).

FIGURE 2:

REP GOVERNMENT OF ALBERTA PROCUREMENT RESULTS – ROUNDS 1, 2 AND 3

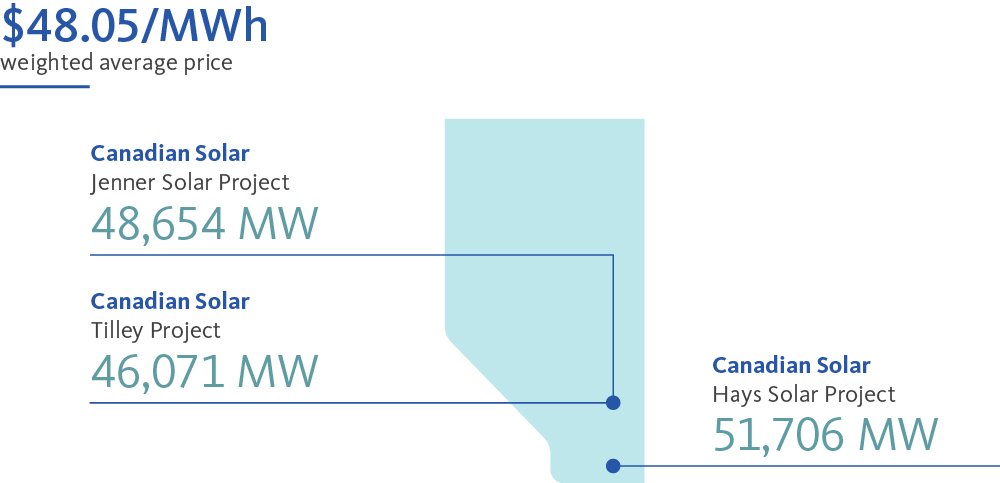

Alberta Infrastructure also ran a solar procurement in 2018 that resulted in the awarding of three 20-year contracts for 146,431 MWh annually (Figure 3).

FIGURE 3:

GOVERNMENT OF ALBERTA SOLAR PROCUREMENT

While the REP was discontinued in 2019, its results provide benchmark pricing and terms, which are otherwise generally lacking in the private PPA market.

Following the success of the REP, the Government of Canada issued a request for information in April 2020 and has indicated its intention to procure one or more 20-year PPAs for 200,000 to 280,000 MWh of Alberta renewable power annually. For more information, please refer to our Osler Update entitled “Opportunity knocks: Federal government launches Alberta-specific wind and solar procurement process” on osler.com.

While government procurements have contributed to the growth of renewable generation in Alberta, Alberta’s renewable energy sector is not dependent on such programs for continued growth. Rather, demand is expected to continue as a result of renewable energy generation costs becoming increasingly competitive with other sources of electrical generation on the provincial grid and different types of investors looking to add renewable energy assets to their portfolios to achieve their ESG objectives. For instance, in 2020, Copenhagen Infrastructure Partners invested in the Travers Solar project in southern Alberta. This project will be Canada’s largest solar project and one of Alberta’s largest producers of environmental attributes under the TIER regime. The project’s investors are prepared to develop the solar plant based solely on merchant revenues. Osler advises the project’s original developer, Greengate Power Corporation, regarding the Travers Solar project.

3. Regulatory uncertainties and related financial risks

Alberta’s unique open market framework presents opportunities and challenges for developers. The commitment by the Alberta government to continue with an energy-only market and to support market-based solutions provided clarity to developers. However, there remains uncertainty with respect to certain key details of Alberta’s regulatory framework.

At the end of 2020, Alberta regulators continue to review several matters:

- Self-supply: Self-supply refers to a facility’s ability to generate its own power for its own use and to sell excess power to the grid. This arrangement has been growing in popularity due to high grid-connection costs and reduced mid-scale generation costs. After finding that self-supply was contrary to Alberta law, the Alberta Utilities Commission (AUC) submitted a discussion paper to the Department of Energy (DOE) on self-supply considerations in 2019. If the DOE decides to permit self-supply, it could represent a meaningful opportunity for renewable power producers looking to partner with large consumers through on-site generation.

- AESO tariff: The AESO is consulting on proposed changes to bulk and regional tariff design through to 2021, which is expected to culminate in a formal application to the AUC for tariff changes. Market participants expect outcomes to clarify generators’ costs for accessing the grid and have the potential to materially impact (either improve or worsen) overall project economics relative to the status quo.

- Distribution system inquiry: The AUC inquiry into how Alberta’s distribution system should adapt to market change concluded in July 2020 and the AUC’s report is anticipated by the end of 2020. Among other issues, the AUC inquired into how distribution service rate structures should be modified to ensure that price signals encourage electric distribution facility owners, consumers, producers, prosumers and alternative technology providers to use the grid and related resources in an efficient and cost-effective way. The eventual outcomes of this initiative, which could drive regulatory, policy and legislative changes, could have material impacts on renewable projects, many of which seek to connect to the distribution system.

Regulators have acknowledged these key issues and are seeking to resolve them with stakeholder input, but certainty is not expected for many months, if not years. In the interim, parties would benefit from clear government direction on priorities identified through regulatory forums (e.g., self-supply).

4. Federal carbon legislation under review

The constitutionality of the Canadian Greenhouse Gas Pollution Pricing Act (GGPA) is currently before the Supreme Court of Canada (SCC). The SCC heard arguments in September 2020 and reserved judgment. On average, SCC judgment is rendered six months after a hearing, so a decision is possible early in 2021.

During oral arguments before the SCC, the federal government asserted that the legislation is a valid exercise of federal jurisdiction under the national concern branch of the Peace, Order and Good Government clause of the Constitution Act, 1867. Without minimum national standards relating to greenhouse gases, actions by one province could adversely impact neighbouring provinces. It further asserted that the levies under the GGPA are valid regulatory charges.

Conversely, the opposing provinces asserted that the legislation is unconstitutional, and that the broad scope of matters regulated under the GGPA encompass a myriad of provincial heads of power. Further, the provinces argue that GGPA carbon levies are neither valid regulatory charges, as there is insufficient nexus between the charge and the regulatory scheme, nor a valid tax, as it has not been passed by Parliament as required by section 53 of the Constitution Act, 1867.

If the GGPA is held to be unconstitutional, the effects of this finding would be mitigated by the fact that provinces currently have their own regimes for regulating carbon emissions or have agreed to comply with the federal government’s requirements, notwithstanding the constitutional challenge. For instance, on November 3, 2020, the Minister of Alberta Environment and Parks, Jason Nixon, signed a Ministerial Order increasing the carbon price under Alberta’s large emitter regime from $30.00/tonne to $40.00/tonne for 2021, in line with federal requirements. Carbon offset markets are therefore likely to continue to be relevant to offtakers and developers.

At the same time, offtakers and developers rely on carbon pricing certainty for PPA pricing, so constitutional challenges relating to that pricing do create a degree of uncertainty in the PPA market, particularly in future years when the provincial regimes deviate from the carbon pricing requirements in the GGPA.

5. Impacts of COVID-19 pandemic

The ongoing COVID-19 pandemic has caused significant disruption to the electricity sector and Alberta’s economy in general. The AESO expects lower electricity demand for the rest of 2020, 2021 and perhaps beyond, with long-term dampening effects on power prices. COVID-19 has increased default, credit and capital-related risks for generators and offtakers alike and brought supply chain disruption and other challenges to project developers. It has also delayed regulatory processes such as those outlined above, with prolonged uncertainty potentially impacting project economics.

The absence of stop-work orders in Alberta throughout the pandemic has somewhat mitigated its impact on industrial activity and the electricity sector. Since March 2020, construction has been permitted on any project that can abide by prescribed guidelines.

Epidemics, states of emergency and other government action often qualify as events of force majeure which excuse performance under a contract or other obligation. Force majeure may provide extensions of time to achieve milestones and/or payment of compensation and permit one or both parties to terminate the PPA without liability if there is a prolonged event, depending on the terms of the PPA.

A change in law provision may be invoked if there has been a change in law that falls within the definition in the contract, such as government actions like lockdowns or forced closures. Cost impacts may be allocated between the parties through a lump sum payment or adjustment to the fixed power price, and one or both parties may be permitted to terminate the PPA without liability if there is a fundamental change in law.

Conclusion

Notwithstanding the novel circumstances in 2020, Alberta’s renewable power market continues to provide considerable opportunities for both developers and offtakers. The expansion in private sector PPA activity, government procurement opportunities and anticipated regulatory clarity stand as bellwethers for growth in 2021 and beyond.

We would like to thank Maeve Sanger and Mike Pede for their contributions to this article.