Osler has a leading venture capital team dedicated to helping investors and emerging and growth stage companies recognize, develop and realize venture capital opportunities.

Our team advises both investors and Canadian companies in the information technology, life sciences, biotechnology, cleantech and alternative energy sectors accessing private capital, on the unique issues involved in venture capital deals.

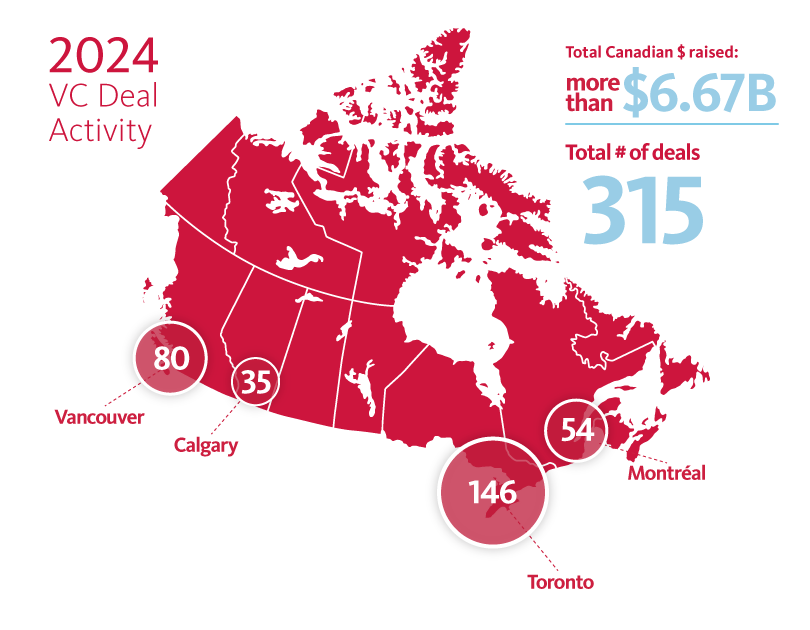

As an active part of Canada’s burgeoning venture capital ecosystem, our firm has worked on more than 547 VC deals over the past three years, representing more than $6.57 billion of investment in Canadian private companies.

Our venture capital team comprises passionate and experienced individuals who take a holistic view of the strategic priorities of our emerging companies and venture fund clients to build and execute on financing strategies consistent with these priorities. In addition to traditional venture capital and angel financings, our lawyers have worked on numerous SR&ED-based financings and collaborative research arrangements that access alternative funding sources, in addition to venture capital.

Venture capital deal flow

Osler has acted on some of the most prominent venture capital financings in Canadian history, including:

- Clio’s U.S.$250 million Series F financing — the largest venture financing deal in Canadian history

- Cohere U.S.$500 million Series D financing

- Waabi U.S.$200 million Series B financing

Cross-border expertise

In addition to working with Canadian funds and emerging companies, our team advises many U.S. funds on their Canadian investments and in other matters related to their Canadian portfolio companies. Combining our Canadian and U.S. business law services gives us the know-how and experience to support our clients in cross-border matters while providing them with a significant “one-stop” advantage, eliminating the need to retain both Canadian and U.S. counsel.

U.S. and other foreign investors take equity positions in Canadian companies in ways that satisfy their tax objectives while preserving relevant tax attributes of the Canadian business. To accommodate these often complex tax issues, our venture capital team collaborates with lawyers in our Tax Group to make sure all tax considerations of a transaction are taken into account. Osler has pioneered some of Canada’s most innovative structures to accommodate the unique regulatory and tax constraints that affect cross-border investments. As a result, lawyers in our tax practice regularly collaborate with our venture capital team.

Exit transactions

Whether as counsel to a Canadian business or to the investors in Canadian companies, our team has played a significant role in many notable M&A transactions involving venture-backed Canadian companies. As the leading M&A law firm in Canada, investors and emerging companies rely on our expertise in structuring and negotiating M&A transactions with strategic and financial buyers, and on our ability to manage these transactions in a time- and cost-efficient manner.

In addition to M&A transactions, our team advises Canadian and U.S. private equity funds, as well as emerging companies, on other forms of exit transactions, such as secondary share sales and capital market transactions.

M&A deal flow

Osler has acted on some of the most notable M&A transactions throughout the years, including

- Intelex in its $570M acquisition by Industrial Scientific

- Wave Financial in its $537M acquisition by H&R Block

- Inversago Pharma in its U.S.$1.075 billion business combination with Novo Nordisk

- Canalyst in its acquisition by Tegus

Fund formation

Our venture capital team has worked closely with the managers of leading Canadian-focused funds on their fund formation activities. Our immersion in the venture capital and entrepreneurship ecosystem, combined with our involvement in a significant portion of VC financings in Canada, means that we are always on top of market practice, including issues such as fund structure, manager compensation, governance arrangements for the management/GP entity, and the amount and structuring of carried interests.

Osler’s venture capital team understands the key issues and considerations that clients need to address and have solved these issues for a number of fund managers.

Some of the current and most often debated issues affecting fund formation today are as follows:

- General Partner compensation — Many funds are considering a structure involving a General Partner priority distribution rather than only a management fee. Our team understands the important tax considerations at play.

- Co-investment rights — General Partners are seeking more flexibility with respect to the structuring of co-investments. This requires careful balancing with conflict of interest considerations.

- Successor fund issues — General Partners are paying more attention to the parameters governing successor fund raising from the outset.

- Management fee offset relief — General Partners are exploring alternatives to the traditional 100% offset mechanism for portfolio company fees.

Fund formation

Emerging companies

In addition to our work with established high growth companies, our team works closely with emerging companies from incubation throughout their growth cycle to provide practical and cost-effective advice on all aspects of their development and issues that they may face, including corporate and tax structure, financings, IP, employment matters, commercial matters and the preparation for and execution of IPO and M&A transactions.

Key Contacts

Partner, Emerging and High Growth Companies, Toronto

Partner, Emerging and High Growth Companies, Calgary

Partner, Emerging and High Growth Companies, Montréal

Partner, Emerging and High Growth Companies, Vancouver

Latest Insights

-

Osler Update January 13, 2026

Navigating the ‘silver tsunami’: how search funds are redefining succession planning in the Canadian SME market

Canada’s founder-led SME market is approaching a demographic inflection point.

Read more -

Report December 4, 2025

Search funds in Canada: navigating cross-border challenges

Read how a Canadian-oriented approach may help reduce the tax inefficiencies inherent in structuring funds based on the U.S. model.

Read more -

Osler Update November 20, 2025

PE Points Newsletter

Osler’s National Private Equity Group has launched its quarterly PE newsletter: your source of private equity news and information.

Read more -

Webinar August 7, 2025

Osler x Women Funding Women: Startup funding & term sheets workshop

Join us on September 24th for a virtual workshop designed for early-stage founders navigating investment and investors looking to deepen their...

Read more

Stay up to date with our latest insights

SubscribeIn the Media

-

Osler News November 28, 2025

Osler leads Canadian firms in Q3 2025 LSEG and Pitchbook venture capital league tables

Osler is proud to be ranked once again as the top Canadian legal advisor in venture capital league tables from LSEG (formerly Refinitiv) and...

Read more -

Osler News November 24, 2025

Osler congratulates the 2025 C100 Growth and 2026 C100 Fellows cohorts

Twelve of Osler’s clients are included in these exclusive programs.

Read more -

Osler News October 28, 2025

Deloitte’s 2025 Technology Fast 50 list features 26 Osler clients

This program recognizes the achievements of Canadian technology companies focusing on their innovation, leadership and rapid revenue growth.

Read more -

Osler News September 9, 2025

Osler again tops Canadian firms ranked for venture capital deals by LSEG and Pitchbook for Q2 2025

Osler has once again topped Canadian firms ranked for venture capital deals by LSEG (Refinitiv) and Pitchbook for Q2 2025.

Read more